Geopolitical and Financial Forecast April 2025: The Energy Crisis, Market Shifts, and Crypto Trends

As we move deeper into 2025, it’s no longer about what could happen — but what has already begun. From the persistent energy tensions to unfolding regulatory crackdowns in crypto, the year is shaping up to be one of economic recalibration. This mid-year update re-evaluates key forecasts with the latest events and adjusts forward-looking projections based on Q1 trends.

Geopolitical Overview April 2025

United States: Geopolitical Dominance and Energy Rebound

Overview of 2025 so far

The U.S. maintained its energy dominance through Q1, with shale production steady and LNG exports hitting record highs amid continued demand from Europe and Asia. Geopolitical tensions with China over Taiwan have intensified, sparking concerns in global tech supply chains. Meanwhile, bipartisan support for stricter foreign investment controls has expanded.

Strategic Alliances

Under President Donald Trump's administration, the U.S. is redefining its global partnerships, emphasizing national economic interests over traditional alliances. This approach challenges the European Union's economic stability and weakens NATO's internal cohesion, potentially leading to a more fragmented European defense strategy.

Energy Policy and Market Impact

The Trump administration has initiated plans to expand offshore oil and gas drilling, including in the Arctic, aiming to increase U.S. energy production. This move is expected to bolster domestic fossil fuel output but may lead to environmental concerns and market volatility.

Environmental Agenda

A shift away from climate commitments is evident, with the administration halting major offshore wind projects like Equinor's Empire Wind. Such actions may cause setbacks in global sustainability efforts, potentially pausing progress on international green initiatives.

Europe: Economic Crisis and Declining Influence

Economic Alliances Under Pressure

The EU’s growing reliance on China will not be enough to counterbalance deteriorating trade relations with the U.S. Internal divisions could lead to disintegration pressures, weakening the bloc’s economic cohesion.

Energy Crisis and Inflation Surge

Europe will struggle with energy shortages and high fuel prices due to reduced imports from the U.S. and Middle East. The transition to renewable energy will slow, exacerbating industrial decline and economic stagnation.

Sustainability Setback

Reduced investments in green technology will slow down the energy transition, limiting the EU’s ability to maintain leadership in climate policy.

Middle East: Energy Superpower in the Making

Shifting Global Alliances

Key players like Saudi Arabia and the UAE will pivot away from the West, strengthening economic and energy ties with China and Russia. A new energy bloc may emerge, further marginalizing Western influence in the region.

Oil and Gas Markets

Geopolitical tensions in the Middle East have led to fluctuations in oil prices, with recent reports indicating a drop to around $64 per barrel due to trade tensions and OPEC+ decisions.

Environmental Strategy

The region will deprioritize sustainability in favor of maintaining its dominance in global energy markets.

Financial Markets Outlook for 2025

Stock Markets: Volatility and Structural Shifts

U.S. Stock Market (S&P 500)

As of April 16, 2025, the S&P 500 stands at 5,275.70, reflecting a 4.44% year-over-year return. The index has shown resilience, buoyed by robust corporate earnings and investor optimism, despite global economic uncertainties.

European Stock Market (Euro Stoxx 50)

Contrary to earlier projections of a significant decline, the Euro Stoxx 50 has maintained relative stability. While specific figures for April 2025 are not provided, historical performance indicates that the index has experienced positive returns in approximately 59% of months between 1987 and 2025. However, ongoing economic challenges and energy concerns continue to pose risks to the European markets.

Currency Markets: Moderate Fluctuations

U.S. Dollar (USD)

The USD has exhibited moderate strength, influenced by steady Federal Reserve policies and global economic factors. The Federal Reserve has maintained the federal funds rate at 4.33% as of mid-April 2025.

Euro (EUR)

The euro has experienced fluctuations, with an exchange rate of approximately 1.14 USD recorded on April 17, 2025. The European Central Bank has implemented several rate cuts, bringing the rate down to 2.25% to combat economic slowdown.

Commodity Markets: Inflation and Scarcity

Oil & Gas

Oil prices have been revised downward, with HSBC adjusting its Brent crude forecast for 2025 to $68.5 per barrel, down from the previous estimate of $73. This adjustment reflects the impact of escalating trade tensions on global demand.

Precious Metals & Raw Materials

Gold prices have seen modest movements, with a closing price of $3,212.68 per ounce on April 15, 2025. Investors continue to monitor inflationary trends and geopolitical developments influencing safe-haven assets.

Agriculture

Wheat futures have shown stability, with prices around $8.80 per bushel for June 2025 delivery. Market participation remains steady, reflecting ongoing assessments of global supply and demand dynamics.

Macroeconomic Trends and Currency Movements

Federal Reserve (U.S.)

The Federal Reserve has held interest rates steady at 4.33% in April 2025, adopting a cautious approach amid persistent inflationary pressures. Officials, including San Francisco Fed President Mary Daly, have indicated that rate cuts may be delayed to ensure price stability.

European Central Bank (ECB)

The ECB has reduced interest rates to 2.25%, marking the sixth consecutive cut, in response to sluggish economic growth and the adverse effects of trade tensions.

Global Market Consequences

The International Monetary Fund projects global growth at 3.3% for 2025, slightly below the historical average. This forecast accounts for varied regional performances, with the U.S. showing resilience while other major economies face headwinds.

Crypto Market Forecast: Institutional Adoption and Regulatory Pressure

Overall Market Condition: Volatility and the New Era of Institutional Dominance

The crypto market is experiencing volatility, with Bitcoin trading above $84,000 as of April 17, 2025. Ethereum's price has seen fluctuations, with recent values around $1,472.55.

The combination of a global recession and a strengthening U.S. dollar amid financial turmoil will drive investors to seek alternative asset classes for capital preservation. Cryptocurrencies are poised to regain their role as a hedge against inflation for both retail and institutional investors.

Meanwhile, tightening regulations in the U.S. and Europe will reshape the industry landscape. Projects that comply with new regulatory frameworks emphasizing transparency and compliance will emerge as market leaders.

Regulatory Landscape: SEC and MiCA as Key Market Drivers

United States (SEC): Stricter enforcement actions against DeFi platforms could restrict U.S. users’ access to various services. While Bitcoin and Ethereum are likely to remain on regulators’ “safe list,” many altcoins and meme coins may face legal constraints.

Europe (MiCA): The introduction of the Markets in Crypto-Assets (MiCA) regulation will enhance transparency and stabilize the EU cryptocurrency market. European exchanges will be required to adhere to higher security and reporting standards, fostering a more structured trading environment.

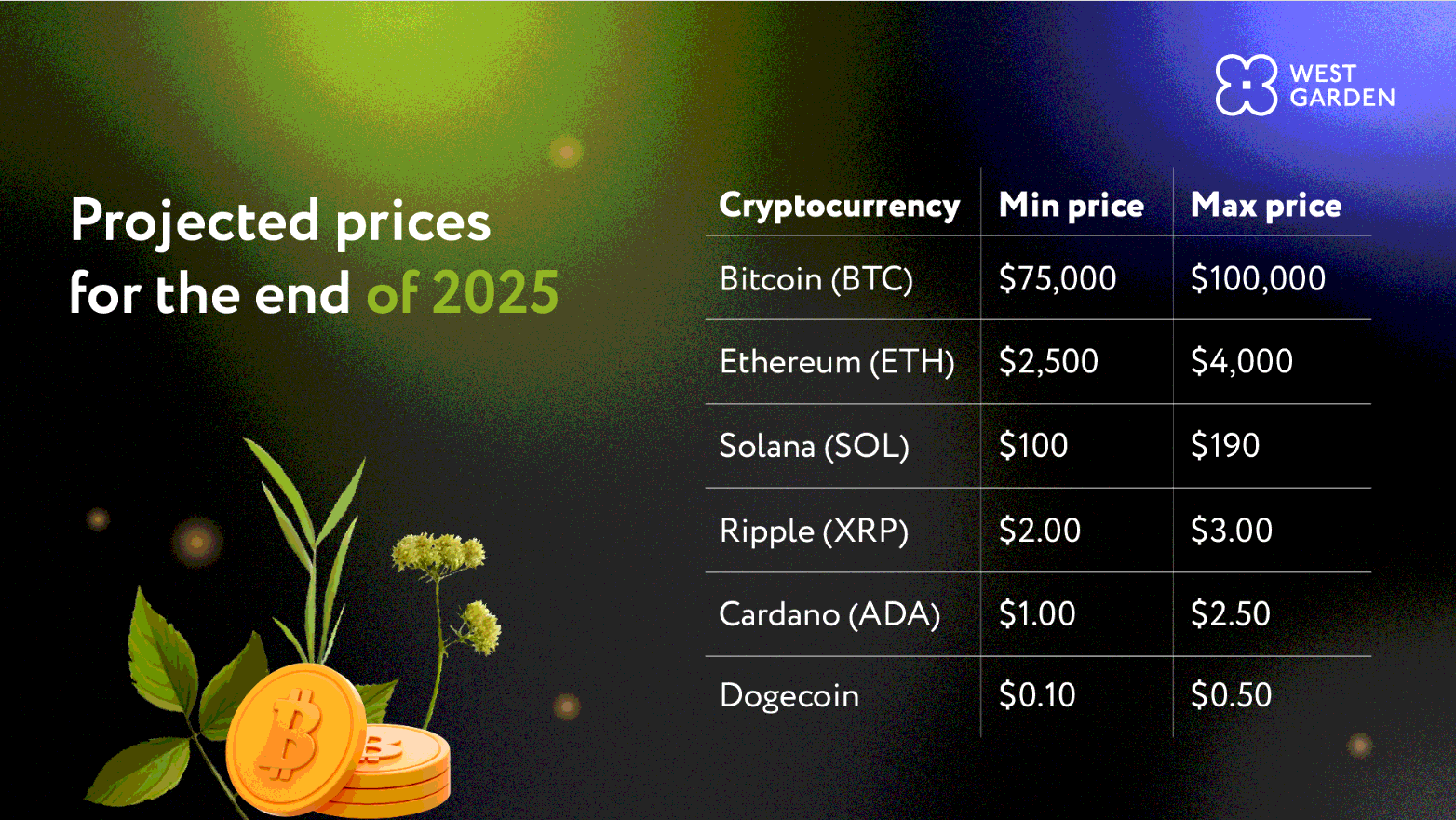

📊 Projected prices for the end of 2025

Leading Cryptocurrencies

Bitcoin (BTC): Despite regulatory pressures and potential macroeconomic shocks, Bitcoin will solidify its position as the premier digital asset. Institutional demand and its fixed supply will support BTC’s price, which could peak around $100,000 during periods of global instability.

Ethereum (ETH): The continued adoption of Proof-of-Stake and the expansion of decentralized finance (DeFi) will bolster Ethereum’s market presence. However, increasing regulatory scrutiny over DeFi platforms could lead to periods of high volatility. Expected price range: $2,500 to $4,000.

Solana (SOL): Network stability issues are expected to improve, strengthening Solana’s position as a competitive alternative to Ethereum. However, its reliance on innovation and venture capital funding may make it more vulnerable during market downturns.

Key Altcoins and Meme Coins

Ripple (XRP): A favorable outcome in its ongoing legal battle with the SEC, along with increased adoption in cross-border transactions, could propel XRP’s price to $2.00-$3.00.

Cardano (ADA) & Polkadot (DOT): These projects will maintain their reputations as promising blockchain platforms, focusing on interoperability and decentralized application (dApp) development. Price potential: $1.00-$2.50.

Meme Coins (Dogecoin, Shiba Inu, etc.): Interest in meme coins will remain short-term and highly volatile. While they may experience price surges during market rallies, increased regulatory oversight will limit their overall influence on the market.

Technological Trends and Innovations

Layer 2 Scaling Solutions: The adoption of Layer 2 solutions such as Arbitrum and Optimism will reduce transaction costs on Ethereum and improve processing speeds.

RWA (Real-World Asset Tokenization): The rapid development of tokenized real estate, bonds, and commodities is expected to expand the market’s value to $10 trillion by 2030.

DeFi 2.0: More resilient decentralized finance protocols with enhanced security measures against fraud and cyberattacks will emerge.

NFT 2.0: A resurgence in NFTs will take new forms, including gaming tokens, digital certificates, and loyalty programs.

Global Impact on the Crypto Market

- Recession Fuels Crypto Growth: As fiat currencies weaken, cryptocurrencies will gain traction as a hedge against economic instability.

- Institutional Adoption Expands: The increasing number of funds and financial institutions integrating cryptocurrency products will drive sustained demand for major digital assets.

- Regulatory Consolidation in the U.S. and EU: Stricter oversight will lead to market consolidation, reducing the number of non-compliant and uncompetitive projects.

Key Takeaways for Investors and Businesses

- Energy prices will dictate market trends—invest in industries resilient to supply chain shocks.

- Currency volatility will impact the U.S. dollar—hedging strategies are essential.

- Crypto will remain an alternative hedge, but regulatory clarity is key to long-term growth.

- Sustainability initiatives will stall, creating both risks and opportunities in green investments.

As we navigate 2025, staying ahead of these shifts will be crucial for maintaining financial resilience and strategic positioning in an evolving global economy.