The year 2024 was a stress test for global financial markets. Despite initial expectations of stabilization, investors faced unforeseen shocks that led to significant volatility and market corrections. One of the most dramatic moments was "Black Monday" on August 5, when Japan’s Nikkei 225 plummeted by 12.4%—its worst drop since 1987. The S&P 500 lost 3%, while the tech-heavy Nasdaq Composite declined by 3.6%. Crypto markets also suffered, with liquidations exceeding $1.7 billion in a single day.

Economic Overview

Throughout the year, major central banks, including the U.S. Federal Reserve, initiated a gradual reduction in interest rates in response to slowing inflation and a need to support economic growth. However, these measures were not enough to counteract the impact of geopolitical instability and sectoral bubbles. One major catalyst of the August downturn was the overextension of large technology firms into AI infrastructure without sufficient investor risk management.

West Garden’s Performance in 2024

Despite the turbulence, West Garden delivered exceptional results, demonstrating the resilience and effectiveness of our diversified investment strategy. Our proactive risk management approach not only protected investor capital but also generated strong returns, far outpacing global market indices.

Portfolio Performance

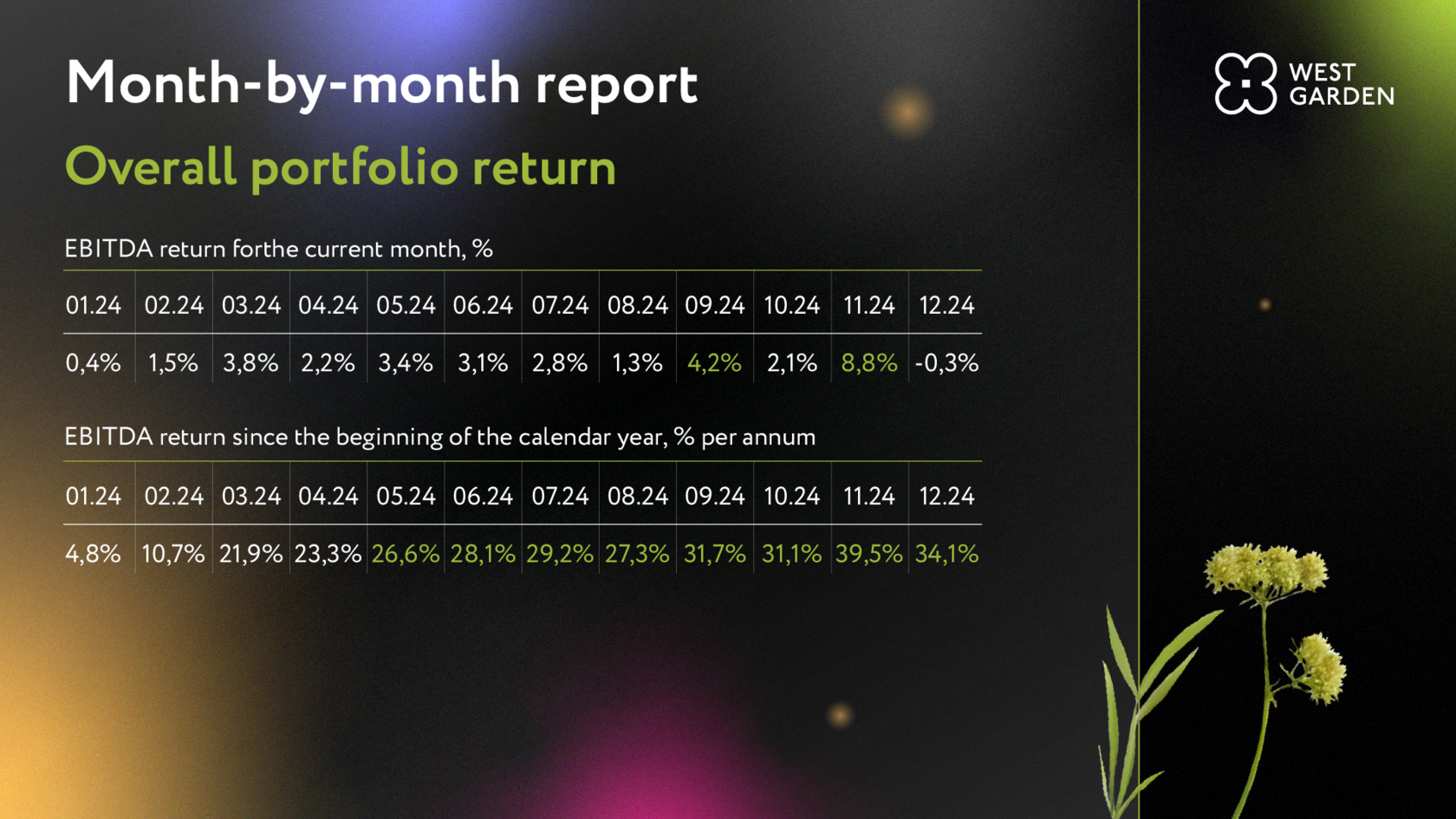

Our EBITDA returns showed consistent growth throughout the year. In September alone, monthly returns reached 4.20%, translating to an annualized rate of approximately 63.9%. The total annual return stood at 34.09%, significantly outperforming traditional asset classes.

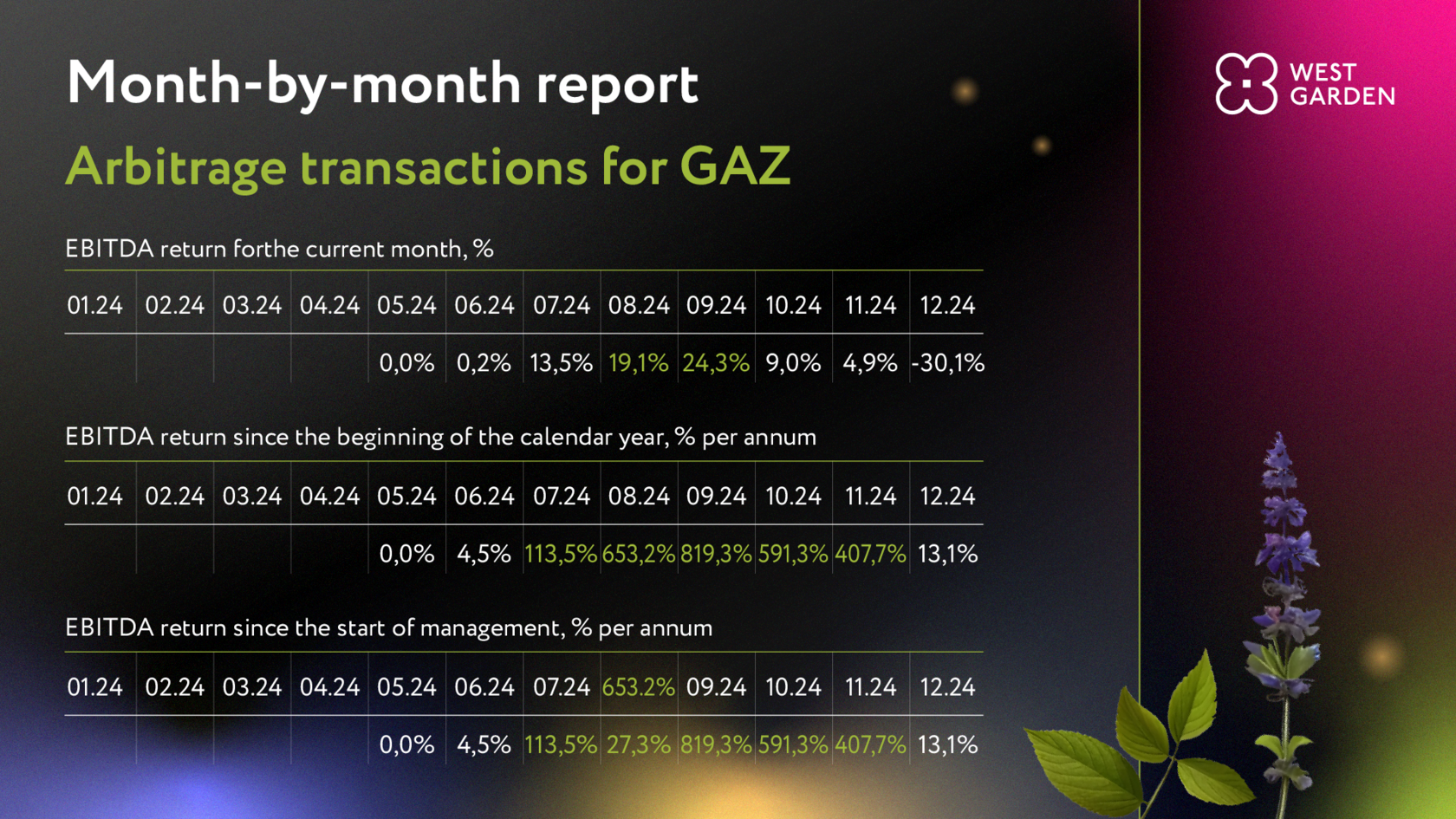

Gas Arbitrage Success

One of our standout achievements was in gas arbitrage. With energy markets experiencing heightened price volatility, our trading team successfully capitalized on market inefficiencies. This resulted in returns of 13.55% in July and 19.12% in August, equivalent to an annualized rate of 600% and 800%, respectively. These results highlight our ability to adapt quickly and seize short-term opportunities in challenging conditions.

Comparison with Alternative Investment Instruments

To assess the effectiveness of our strategy, we compared our returns with various investment instruments in 2024:

- U.S. Government Bonds: The yield on 10-year U.S. Treasury bonds remained around 3.5%, significantly lower than our annual return.

- Gold: Gold prices saw an increase of approximately 27.2% over the year, yet they still fell short of our performance.

- Oil (Brent): Brent crude oil prices rose by only 0.7% in 2024, making this asset less attractive compared to our strategy.

- Cryptocurrencies: Despite Bitcoin’s strong growth in 2024, some cryptocurrency hedge funds underperformed compared to us. For instance, the Fasanara Digital fund posted a 24% annual increase, which still lagged behind our returns.

- Biotech Sector ETF: The SPDR S&P Biotech ETF (XBI), which invests in biotechnology companies, grew by 8% in 2023. While 2024 data is unavailable, given the sector’s volatility, it is likely that its returns were lower than ours.

- Chinese Internet Sector ETF: The KraneShares CSI China Internet ETF (KWEB), focused on Chinese internet companies, has shown a decline of 19% in recent years. Although precise 2024 data is lacking, ongoing regulatory risks in China suggest its returns were likely below ours.

Development of Algorithmic Strategies and Innovation

At West Garden, we manage our portfolio not only to generate returns but also to continuously refine our algorithmic models. In 2024, we developed and tested over 50 new trading scenarios tailored to the evolving macroeconomic landscape. These models incorporate interest rate analysis, inflation trends, geopolitical risks, and liquidity fluctuations, enhancing our predictive capabilities.

Advancements in Algorithmic Trading

This year, we made significant strides in hybrid machine learning models and adaptive trading algorithms that dynamically adjust to market conditions.

- Reinforcement Learning for Trading Strategies

- We implemented reinforcement learning techniques, allowing our algorithms to self-optimize based on real-time market data. Unlike traditional rule-based strategies, our system continuously adapts to evolving conditions, improving decision-making and execution.

- Enhanced Data Processing and Trade Execution Speed

- Our upgraded low-latency trading framework has reduced execution times, minimizing slippage and improving efficiency. Additionally, we integrated new volatility forecasting algorithms leveraging combined statistical methods and transformer models, which mitigated risks in high-frequency trading environments.

Our technological advancements and accumulated expertise position us to bring market-ready algorithmic solutions tailored to different investment environments. As we continue testing our models, our research into hybrid AI strategies will not only keep West Garden at the forefront of the industry but also help shape new standards in capital management.

Markets in 2024 experienced multiple waves of high volatility, from sudden crashes and inflation spikes to sharp interest rate swings and liquidity shifts. Rather than avoiding instability, we learned to navigate it—using macroeconomic scenarios and algorithmic approaches to generate profits where others saw losses.

Month-by-month report

It is important to highlight that West Garden didn’t just adapt to challenging market conditions—we leveraged them to achieve outstanding results. While many investors faced steep drawdowns and losses in 2024, our strategy—built on dynamic risk management, in-depth macroeconomic analysis, and adaptive algorithms—not only preserved capital but also delivered steady growth throughout the year.

Now, let’s take a closer look at how our strategy performed month by month, the key factors influencing our returns, and why West Garden outperformed major global indices and alternative investment instruments

2024 was a year of volatility, uncertainty, and shifting market dynamics. Yet, while many investors faced steep losses, West Garden thrived by leveraging dynamic risk management, deep macroeconomic analysis, and adaptive algorithmic strategies. Instead of merely navigating market turbulence, we transformed it into opportunity—outperforming traditional benchmarks and alternative asset classes alike.

As we move forward, we remain committed to innovation, agility, and delivering superior value to our investors. We thank our investors for their trust and look forward to another year of strategic growth and success.

As we move forward, we remain committed to innovation, agility, and delivering superior value to our investors. We thank our investors for their trust and look forward to another year of strategic growth and success.