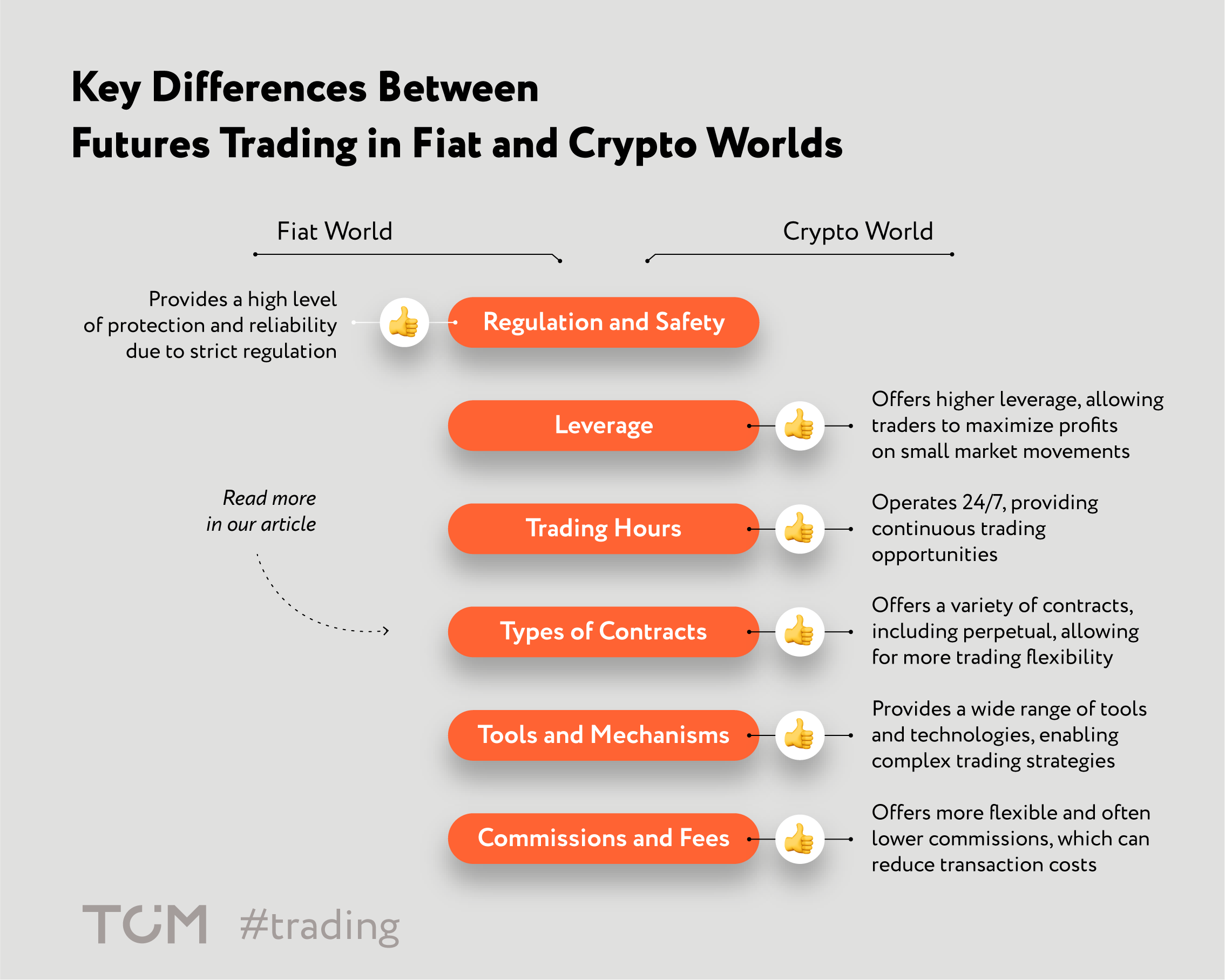

Understanding the distinctions between futures trading in traditional fiat markets and the cryptocurrency realm can help investors tailor their strategies effectively.

Regulation and Safety

Leverage

Trading Hours

Types of Contracts

Tools and Mechanisms

Commissions and Fees

Regulation and Safety

- Fiat World: Futures trading in traditional markets is highly regulated by government agencies such as the SEC and FCA. These regulations ensure a high level of investor protection and establish strict security standards.

- Cryptocurrency World: The crypto market operates with less global regulation, leading to varied levels of safety and protection depending on the exchange. While some exchanges maintain robust security measures, the regulatory landscape for cryptocurrencies is still evolving.

Leverage

- Fiat World: Traditional futures markets typically offer limited leverage, usually up to 10-20x, with stringent margin requirements.

- Cryptocurrency World: In contrast, crypto markets offer significantly higher leverage, often exceeding 100x, with more flexible margin requirements. This flexibility allows investors to choose between cross and isolated margins based on their risk tolerance.

Trading Hours

- Fiat World: Traditional markets have fixed trading hours with breaks on weekends and holidays, which restricts trading opportunities.

- Cryptocurrency World: Crypto markets operate 24/7, providing continuous liquidity and allowing traders to engage in transactions at any time.

Types of Contracts

- Fiat World: Futures contracts in fiat markets are well-defined with fixed expiration dates and standard terms and conditions.

- Cryptocurrency World: The crypto market features perpetual futures contracts with no expiration dates, along with a variety of contract types that may have non-standard conditions.

Tools and Mechanisms

- Fiat World: Traditional futures markets use standard tools such as futures and options with regular settlement mechanisms.

- Cryptocurrency World: Crypto exchanges offer a wide range of instruments, including perpetual contracts, options, and staking. Additionally, mechanisms like funding rates for perpetual contracts provide further flexibility.

Commissions and Fees

- Fiat World: Commissions in fiat markets are transparent and regulated, with fixed fees for transactions.

- Cryptocurrency World: Crypto exchanges feature varying commission structures, which can depend on the exchange and type of transaction. Some exchanges offer low or zero commissions for specific operations.