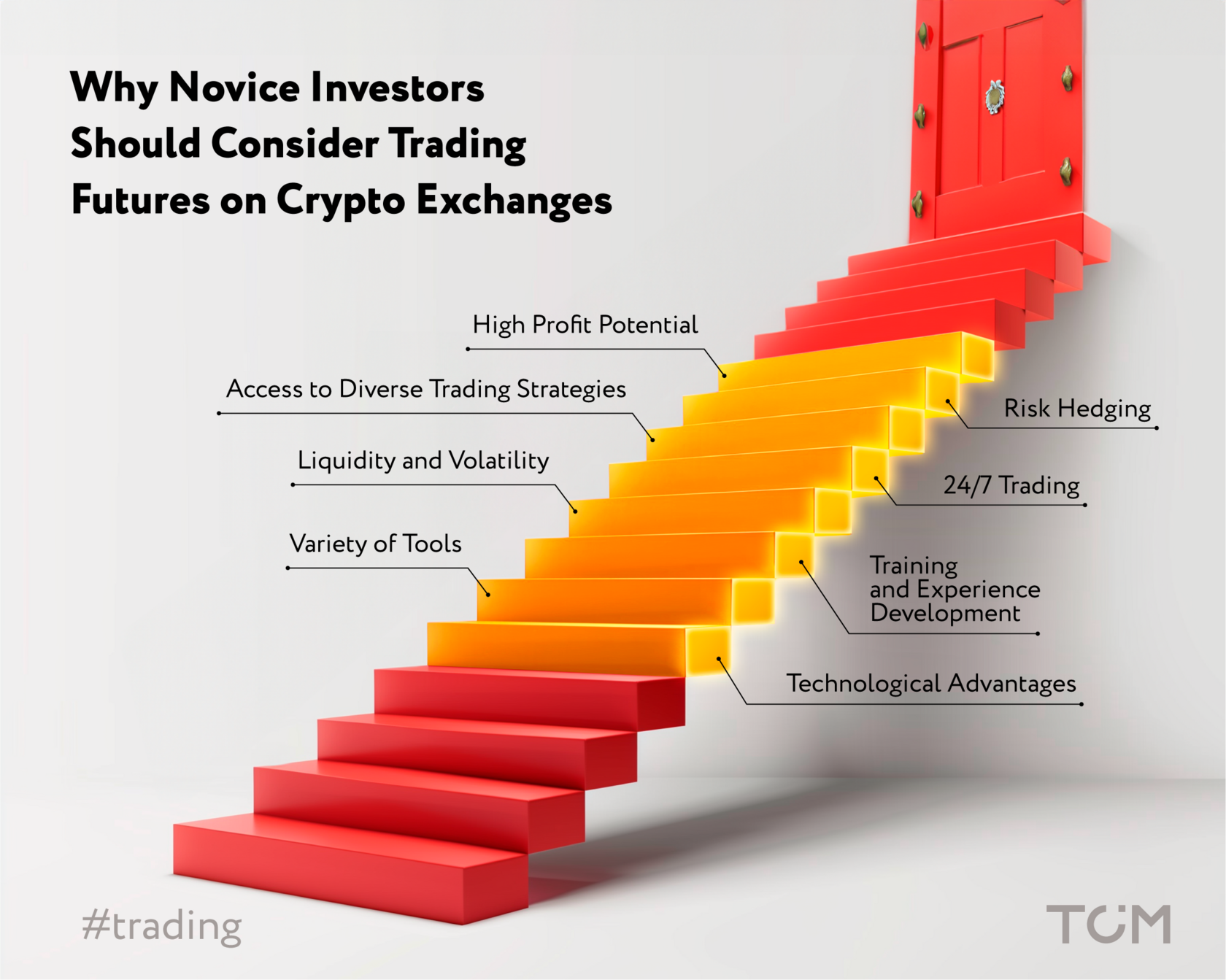

Trading futures on a crypto exchange offers several compelling benefits for novice investors. Here’s why this avenue might be both intriguing and advantageous for those new to the investment world.

- High Profit Potential Futures contracts are appealing due to their leverage capabilities, which allow investors to control a large position with relatively small capital. Leverage can amplify profits significantly, enabling substantial returns even with modest initial investments. For instance, with leverage, a small price movement can lead to substantial gains, making capital utilization more efficient and offering the potential for high rewards with relatively low outlay.

- Risk Hedging One of the primary benefits of trading futures is their ability to hedge against price fluctuations in cryptocurrencies. By taking positions that counteract potential adverse movements, futures contracts can protect an investment portfolio from market volatility. This hedging capability helps to mitigate risks associated with sudden price changes, thereby reducing overall portfolio volatility and providing a safeguard against unforeseen market shifts.

- Access to Diverse Trading Strategies Futures contracts enable investors to explore a wide range of trading strategies, including arbitrage, spreads, and hedging. For novice investors, this variety provides an opportunity to learn and apply different tactics, enhancing their trading skills and expanding their understanding of the market. Employing various strategies can also improve profitability by capitalizing on different market conditions and price movements.

- 24/7 Trading Cryptocurrency markets operate continuously, 24/7, unlike traditional financial markets that have fixed trading hours. This around-the-clock availability allows investors to trade at their convenience, providing flexibility to react to market events as they happen. The constant market access ensures that opportunities are not missed and allows for immediate responses to market changes.

- Liquidity and Volatility The cryptocurrency market is known for its high liquidity and volatility. High liquidity facilitates easy entry and exit from positions, ensuring that trades can be executed swiftly. Volatility, on the other hand, creates opportunities for profit through short-term price movements. Novice investors can leverage these characteristics to make gains from rapid market fluctuations and capitalize on temporary price swings.

- Training and Experience Development Engaging in futures trading can be an excellent way for novice investors to gain hands-on experience and deepen their understanding of financial markets. Through practical trading, investors develop analytical skills, learn about market dynamics, and gain insights into factors that influence asset prices. This experiential learning is invaluable for building expertise and confidence in trading.

- Variety of Tools Crypto exchanges offer a broad array of futures contracts across various cryptocurrencies. This diversity allows investors to diversify their portfolios by investing in different assets and exploring new projects. Diversification helps in managing risk and capturing opportunities in emerging and promising cryptocurrency ventures.

- Technological Advantages Many crypto exchanges provide advanced trading platforms with cutting-edge analysis tools and automation features. Investors can benefit from sophisticated technical analysis to make informed trading decisions and use trading bots and algorithms for automated trading. These technological advancements enhance the trading experience and improve the efficiency of executing strategies.